Henk Vording: The Two-Pillar Approach to International Tax Reform

Date:2024-12-24

On May 14 and May 21, 2024, Henk Vording, Global Chair Scholar at Peking University Law School, Professor at Leiden Law School in the Netherlands, member of the Academic Committee of the European Association of Tax Law Professors, and Board Member of Directors of the Netherlands Association for Tax Research, gave two academic lectures on the topic of "The Two-Pillar Approach to International Tax Reform". The lecture was chaired by Professor Zhang Zhiyong from Peking University Law School, with nearly 100 attendees from both within and outside the university. The event received an enthusiastic response.

This article will present the core points of the lecture as a transcript.

Henk Vording:

In these two lectures, we will discuss the two-pillar program for international tax reform. The two-pillar program was introduced in response to the challenges faced in the field of international taxation. On the one hand, emerging economies have demanded a change in the long-standing dominance of developed countries in international tax rule-making and have put forward their own interests; on the other hand, the number of multinational enterprises has been growing rapidly in the last decades. This was a situation that had not yet arisen when the basic framework for international taxation was established more than 100 years ago. More than 100 years ago, in order to harmonize the tax interests of resident and source countries, the League of Nations commissioned experts to carry out a study. In 1923, four economists, led by the American scholar Seligman, submitted a Report on Double Taxation. On this basis, the following consensus on the system of international tax rules was formed: the source country has a preferential but limited right to tax positive income, and levies a low withholding tax, or no withholding tax, on negative income; the resident country has the ultimate and unlimited right to tax negative income; and the principle of independent transactions is adopted for the taxation of connected transactions. At the present time, however, these understandings are being reconsidered: in terms of the degree of tax linkage, pillar I allocates profits to the market country of the multinational enterprise's consumers rather than to the traditional resident or source country; and in both pillars I and II, a group approach to taxation has been adopted, which departs somewhat from the principle of independent transactions.

Base Erosion and Profit Shifting (BEPS) Action Plan

Understanding the two-pillar approach requires a review of the BEPS action plan, which has been in existence for a decade. BEPS refers to base erosion and profit shifting, which means that taxpayers take advantage of the differences in tax regimes and mismatch of rules in different tax jurisdictions to artificially shift their profits to low-tax (or no-tax) countries (or regions) where they have no or almost no substantial business activities, or to use pre-tax deductible payments, such as interest or royalty, to Tax planning strategies that erode the tax base.

Next I will show several tax planning scenarios.

The first scenario is a hybrid mismatch. The second scenario is a basic model of cross-border tax planning. The third scenario is tax planning for withholding tax. The fourth scenario is a classic example of transfer pricing.

Overall, the BEPS project has been effective. However, the BEPS outcomes were predominantly policy recommendations rather than minimum standards. Tax planning by multinational enterprises is still prevalent after the BEPS tax reform. In addition, the report on the results of BEPS Action Plan No. 1 did not manage to present solutions to the tax challenges posed by the digital economy. As a result, we are now entering the BEPS 2.0 era, which is centered on a "two-pillar" approach.

BEPS 2.0: Pillar 1 and Pillar 2

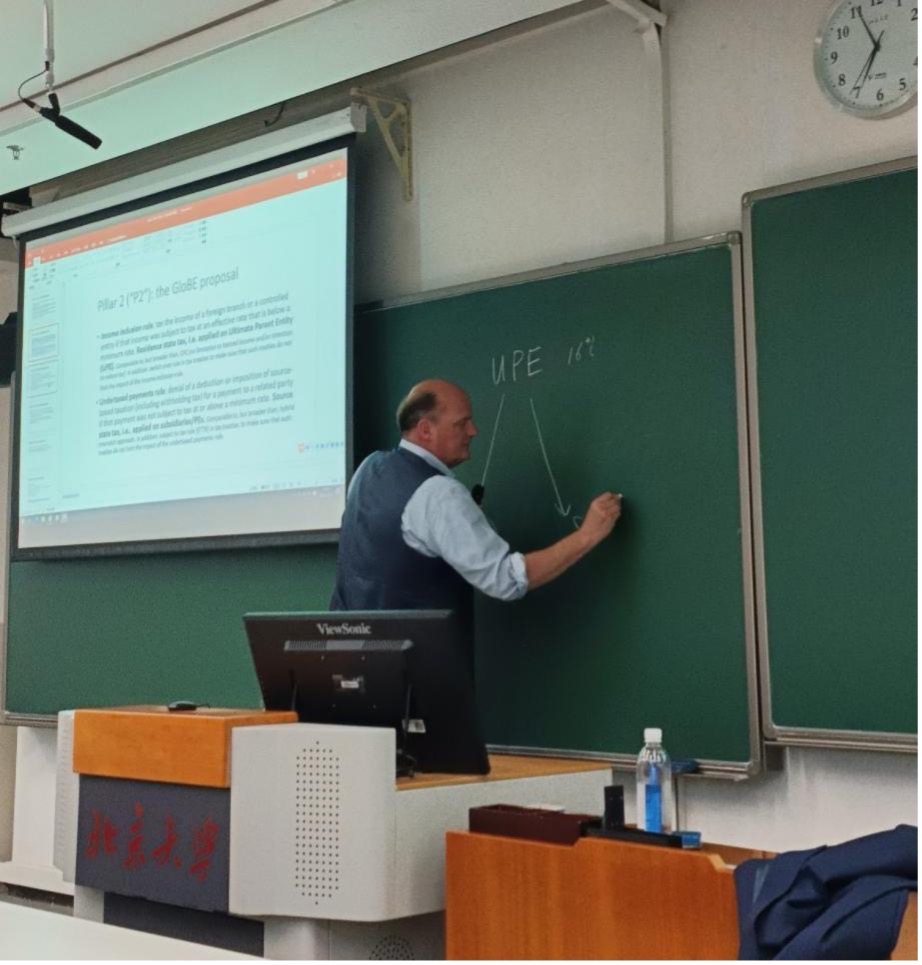

In 2019, the Organization for Economic Co-operation and Development (OECD) proposed a "two-pillar" program design for the first time. Since its inception, the "two-pillar" program has been proposed in the context of a work plan to address the tax challenges posed by the digital economy, but it actually covers a broader scope. The difference between Pillar I and Pillar II is that Pillar I deals with "who should tax" and Pillar II deals with "at least one country should tax".

In addition to the above rules, there are four details that deserve attention. The first is the introduction of the Qualified Domestic Minimum Top-up Tax (QDMTT). The second is the Subject to Tax Rule (STTR). Third, there is the Substance Based Income Exclusion (SBIE). Fourth, there is the Refundable Tax Credit versus the Non-Refundable Tax Credit .

At this point, we have had some discussion of the Pillar II program. It is still not entirely clear how Pillar II will evolve in the future. We have also learned some of the technical details, but more critical is the purpose and context in which the rules were designed. If you understand the purpose for which the rules were designed, you can understand the rules more easily; if you understand how taxpayers utilize the rules, you can understand why the tax rules are so complex.

Zhang Zhiyong:

Prof. Vording helped us understand what the two-pillar program is all about. We need to know what the new rules are and then try to think about the interaction between the new and old rules. The way the real world works may not be consistent with the original design of the rules, and the rules themselves may change, so we need to keep watching. Furthermore, for some developing countries, attracting more foreign direct investment to promote economic development remains a priority. Taxation is only one of the factors influencing investment, and non-tax-related issues also deserve our attention.

Speaker Introduction:

Henk Vording has been Professor of Tax Law at Leiden Law School from 2006 to the present and is a former Vice Dean of the School. He has been a visiting professor at the University of California, Hastings College of the Law. He is also a member of the Academic Committee of the European Association of Tax Law Professors, a Board Member of Directors of the Netherlands Association for Tax Research and a former member of the Dutch Tax Reform Commission. He received his M.A. in History and his J.D. from Leiden University, where he was Assistant Professor of Law at Leiden Law School in 1986 and Associate Professor of Tax Law and Economics at Leiden Law School in 2004. His courses include Introduction to Tax Law, Philosophical Theory of Taxation, and European Tax Policy. His research areas include European and international tax law and policy (with a focus on corporate income tax), the historical development of tax law and its institutions, and the philosophical foundations of taxation and redistribution. His recent academic publications include "What makes the Netherlands a tax haven for multinational corporations" (2019) and “Dutch tax policy statement 2020” (2019).