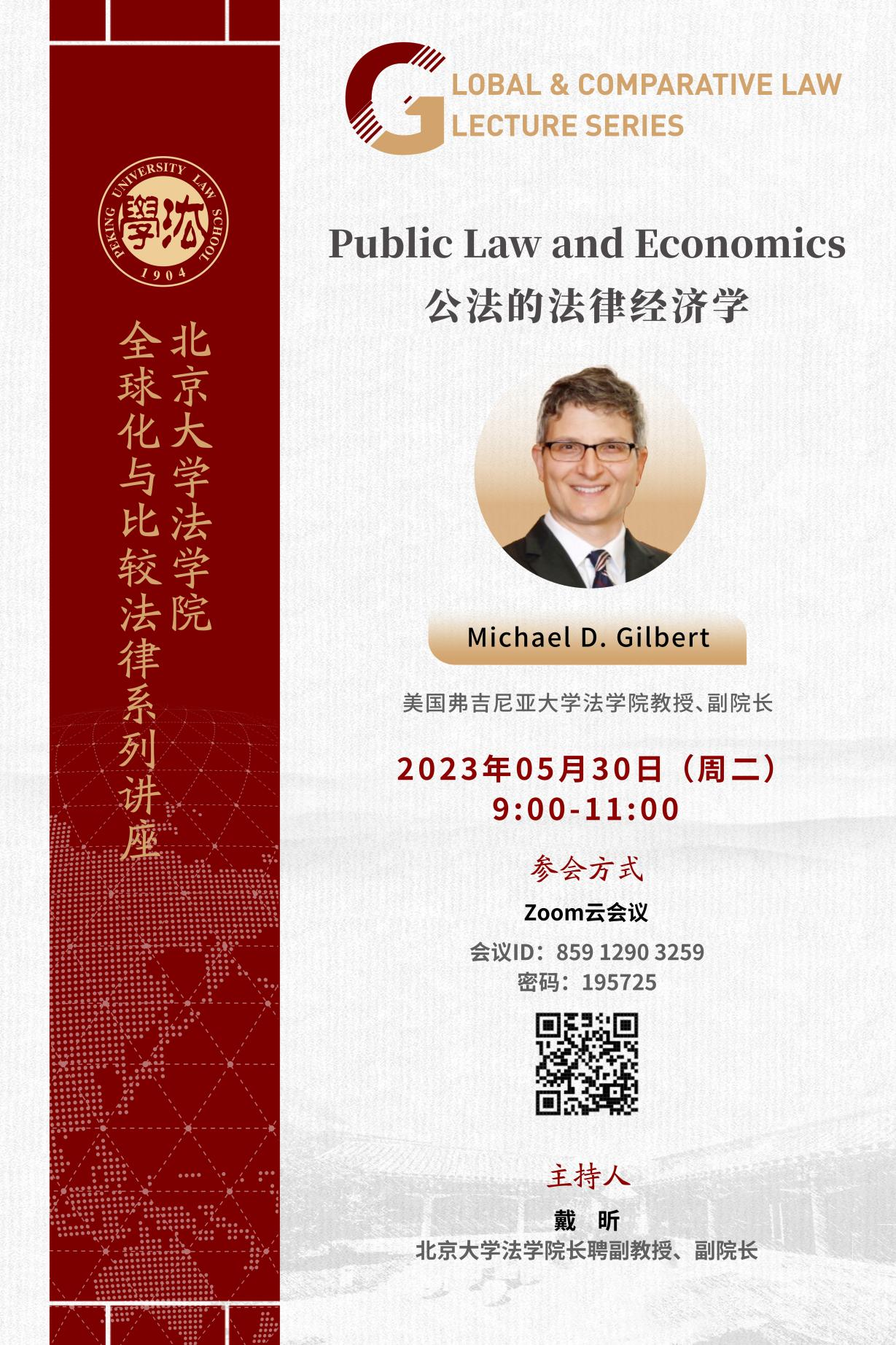

Michael D. Gilbert: Legal economics of public law

Date:2023-12-27

On the morning of May 30, the professor and associate Dean of the University of Virginia School of Law Michael D. Gilbert An online academic lecture was held on the title of "Legal economics of public Law". The lecture was presided over by Dai Xin, vice dean of Peking University Law School. In this lecture, the Michael D. Professor Gilbert shared his cutting-edge understanding of law and economics, and the activity responded enthusiastically.

This lecture mainly focuses on the development history and research examples of public law and legal economics. This article will present the core points of the lecture in a written transcript.

Michael D.Gilbert:

1. The history of legal economics of public law

Compared with law, economics derived from Smith's The Wealth of Nations has a short history, and then gradually penetrated into the field of private law research and the field of public law research that we advocate.

In the 19th century, legal people generally regarded economics as a tool to determine the facts, and did not believe that economics could guide the operation or interpretation of law. In the 1960s, economics entered the mainstream vision of legal research under the promotion of Coase and Posner, and gradually formed today's legal economics. In the current academic circle, it is common to adopt the research method of legal economics in the field of private law (such as tort law, property law, contract law, company law, etc.), but this research paradigm is not widely accepted in the field of public law. The most used economic concept in the public law field is cost-benefit analysis, but this is also mainly adopted in the process of policy making.

The resistance of public law circles to the research paradigm of legal economics may be related to scholars' misreading of economics. Economics emphasizes "efficiency", while public law scholars generally equate "efficiency" with "money", and therefore criticize the legal economics paradigm for the neglect of non-monetary values such as fairness and justice. This view is wrong. The maximization of efficiency is not the maximization of money, but the maximization of public preferences. The concept of "efficiency" in economics is far more extensive than "money". I and Robert D in the field of legal economics. Professor Cooter co-authored the book Public Law and Economics, aiming to further introduce the research paradigm of legal economics in the field of public law. In this book, we use legal economics to discuss many traditional American public law issues, such as federalism ,entrenchment and so on.

2. Example of public law and legal economics

Legal economics can help us understand the separation of federal and state powers under the United States Constitution. In the view of economics, a person's behavior may affect the welfare of bystanders without compensation, which is externality. If the impact on bystander welfare is regular and positive externality, otherwise it is negative externality. Reving powers such as the navy to the federal government is based on external considerations. Since its independence, the United States has urgently needed to build a navy in case of a potential renewed war with Britain. The act of building a navy has positive externalities, and if this responsibility is transferred to one state, other states may free up, and all states are not actively building a navy, which will cause greater damage to social welfare. The United States Constitution reserved navy-related issues to the federal government, internalizing externalities to address the issue. Externalities can also explain why the US Constitution uses the vague language of general welfare in authorizing Congress to collect taxes. This is also actually designed to solve the externalities. Coase believes that externalities can be resolved through bargaining, but this requires low transaction costs. In the practice of taxation, it may be difficult for states to agree on something, and the federal government is needed to intervene to tax.

Legal economics can also promote our study of the norms of public law rights, such as the application mode of anti-discrimination norms. Employers in the United States ask candidates to say whether they have been punished for a crime, a practice criticized by the public for disrespecting those who have served their sentences. After the law prohibited questioning a candidate's criminal record, employers began speculating on the candidate's race, making it relatively more difficult for minorities to find jobs. In fact, it may not be the employer asking for the criminal record that makes it difficult for people to integrate into the society, but precisely because the criminal record asked by the employer is too rough. In New York State, subway fare evasion is a misdemeanor, but no employer cares about such trivial matters. Such problems in American society are related to the unclear information content and presentation of criminal record documents. Unless you is a criminal law expert, it is difficult to understand what the charges in criminal record documents mean.

Legal economics can also help us to think about the problem of fake news. American society often suffers from false news because the First Amendment protects the high cost of speech and litigation. The perspective of legal economics can help us to influence people's behavior through system design under the condition of constitution and legality, so as to alleviate the problem of false news. For example, we can allow publishers on social media to provide pledge money to third-party trusts in exchange for an endorsement of the authenticity of their publications, such as setting special colors for their speeches. Everyone can challenge the authenticity of the speech to a third party's private arbiter (the First Amendment to the United States Constitution does not allow public institutions to interfere in the speech), and if the challenge is successful, they can get the money pledged by the information publisher.

Question:

The research methods in the book Legal Economics of Public Law are not rare in economics, political science and other fields. Why do economists and political scientists rarely study public law issues?

Michael D.Gilbert:

The main reason is that economists and political scientists do not know how the law works. They can only put forward more abstract theories and the description and explanations of external institutional phenomena in the field of public law, but it is difficult to respond to the specific public law issues that legal people are concerned about.

Question:

Why do legal people resist the research paradigm of legal economics in the field of public law?

Michael D.Gilbert:

Legal people often seek the answers to legal questions by exploring the general meaning of the wording, legislative history, etc. Therefore, it is only natural that it is often unacceptable when trying to introduce an economic paradigm. However, in practice, many of the explanations sought by traditional legal people are only subjective products. Instead of allowing legal people to create themselves, it is better to let them create again after understanding the principles.

Question:

Is there any room for bargainin) in public law?

Michael D.Gilbert:

Bargaining is everywhere in the public law. The major issue being dealt with in the United States is how to repay the debt. The spokesmen of all parties will speak a lot of grand words to the media, but behind the scenes will seek reconciliation through exchange, the process is bargaining. The judicial process is also similar. The nine justices of the Supreme Court of the United States are also negotiating in the process of reaching the judgment, such as "you add this paragraph in the judgment and I will support your position". Of course, there are also some things that are not allowed to trade in public law, such as not selling human organs.

Question:

Is the concept of externalities too broad? Will all the public law intervene?

Michael D.Gilbert:

There are externalities in our lives, but not every time. In addition to emphasizing externalities, legal economics also considers the cost of regulating such externalities. If the cost is greater than the benefits of regulation, it will not regulate.

Question:

Economics emphasizes personal preferences, but are there preferences in countries in public law?

Michael D.Gilbert:

It is difficult to determine national preferences in practice, which is also one of the difficulties in the field of international relations research. What economics can do is to simplify, and not to fully reflect the reality. The same problem is also very common in the traditional areas of economics. Traditional economics assumes that individual preferences remain unchanged, but in reality people's preferences are changing all the time. This does not mean that the research paradigm of legal economics is much better than no method.

Question:

What is the biggest difference between public law and legal economics and other research paradigms such as public choice and political economy?

Michael D.Gilbert:

The biggest difference is that public law legal economics focuses on specific institutions and legal teachings, which does not understand how society operates like other social sciences, but deals with specific problems encountered by legal people.

Translated by: Liu Zhongzheng

Edited by: Ren Zhiyi