The 25th Peking University Corporate Legal Risk Forum was successfully held

Date:2019-10-31

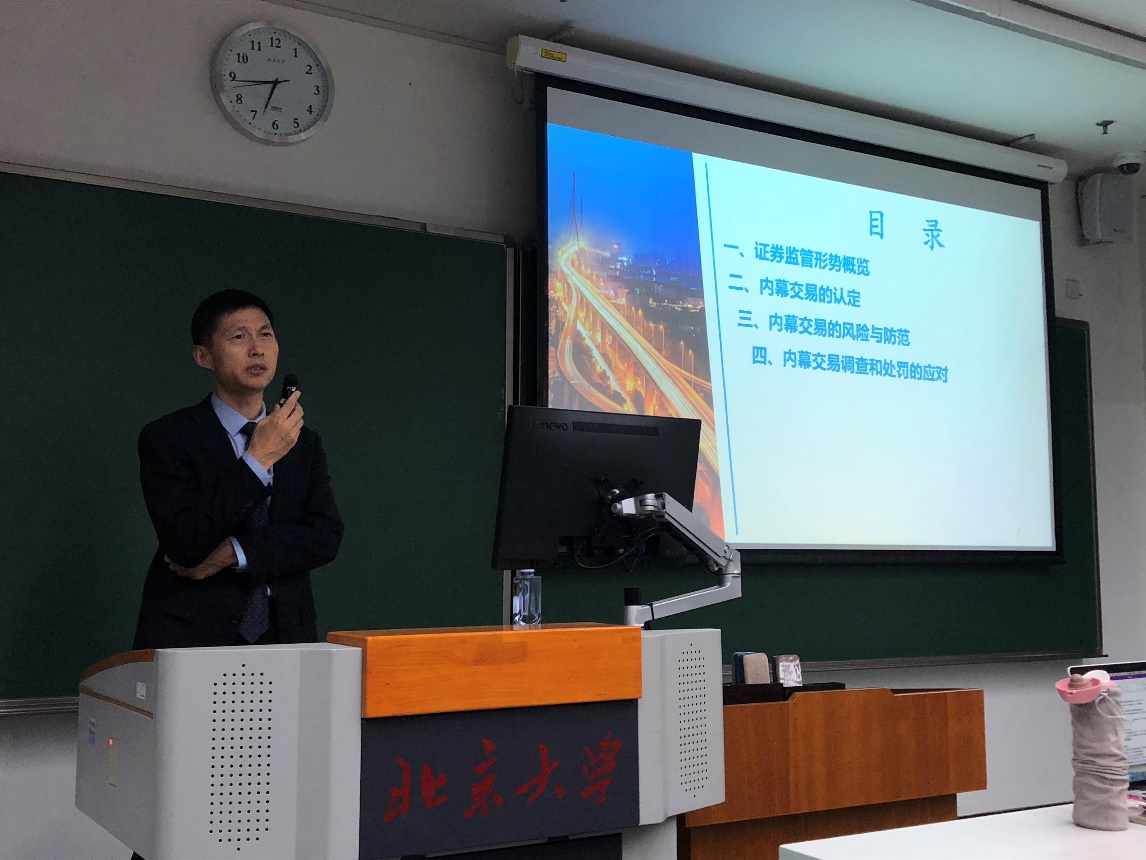

At 18:40 on October 11, 2019, the 25th Corporate Legal Risk Forum organized by the China Enterprise Legal Risk Management Research Center of Peking University was successfully held in the second teaching building 314 of Peking University. This forum invited Mr. Zhang Baosheng, a partner of Zhong Lun Law Firm, to give a lecture on the topic of Securities Insider Trading Recognition and Risk Prevention. The forum was presided over by Prof. Jiang Daxing from Peking University Law School. The graduate students PKULS actively participated in the discussion and had a heated discussion in the report process. After a warm welcome from the teachers and students present and a brief introduction to Mr. Zhang, the lecture officially began.

The content of the lecture is mainly divided into four parts. The first part is an overview of the securities regulatory situation. In this part, Mr. Zhang talked about the four eras of securities market supervision and the latest situation, and believed that the overall situation of securities market supervision in recent years is wide-ranging and severely penalized. This situation can be seen in the characteristics of "special law enforcement, joint law enforcement, normalization", "number of cases filed, number of penalties, high amount of fines and penalties" and "investigation of intermediaries". Subsequently, Mr. Zhang introduced the number of insider trading cases from 2016 to 2018, and explained the securities supervision situation of China's current severe penalties through the Huang Guangyu, Du Juan, Xu Zhongmin insider trading case and everbright securities insider trading case.

The second part of the lecture is the identification of insider trading. In this section, Mr. Zhang starts from the relevant provisions of the Law and the Securities Law, and clarifies what is insider trading and insider information. He pointed out that the core points of identifying insider trading include insider information, sensitive period (before formation and post-publication), and use of insider information trading, while the key elements of insider information are importance and non-disclosure. On this basis, Mr. Zhang used a number of cases to explain the certainty of insider information, the sensitive period and formation time of inside information, the disclosure of inside information, the identification of insider information of “utilization”, the form of inside information, and the calculation of illegal income. Unit insider trading and personal insider trading and other knowledge related to insider trading, and answered questions from students present.

The third part of the lecture is the investigation, risk and prevention of insider trading. First of all, Zhang introduced the investigation of insider trading in the order of the division of labor of securities regulatory agencies and judicial organs, the handling of insider trading cases, and the initiation of insider trading investigation procedures. He showed that under the big data system, today’s insider trading has There is no secret at all. Secondly, Mr. Zhang explained the legal liability of insider trading through the cases that occurred in reality, and summarized the characteristics of insider trading cases. In addition, Mr. Zhang also explained the causes of frequent domestic trading cases from the level of law enforcement, the level of offenders and the internal supervision of the company.

The fourth part of the lecture is how to correctly face insider trading investigations and administrative penalties. In this part, Mr. Zhang described the misunderstandings and improper practices of the parties involved in the investigation of insider trading in real life, and proposed that in the face of regulatory investigations, it is necessary to seek early involvement of experienced lawyers. Since then, Mr. Zhang has shared the defense points that do not constitute insider trading through a number of cases, and summarized the lectures. He believes that: 1. High return on capital market, high cost, high risk, and huge risk of insider trading; 2. There is no absolute secret in the era of informationization and big data; 3. For law enforcement, it is necessary to investigate and deal with it according to law, don’t enforce law like activities. 4. The identification of insider trading is highly professional, and there are many disputes. In many cases, there is a large space for debate between the prosecution and the defense. The result of each insider trading case is not constant, is the outcome between the law enforcement department and the party 5. For capital market participants, the capital market must be awe-inspiring, understand the bottom line, do not step on the red line, but also keep up with the times, relying on professional lawyers, dance with wolves. Later, the classmates all rushed to ask Mr. Zhang, and Mr. Zhang also answered questions from the students, which benefited the students.

Finally, on behalf of Peking University China Enterprise Legal Risk Management Research Center, Prof. Jiang presented a certificate of appreciation to Mr. Zhang. In the applause of the teachers and students, the forum was successfully concluded.

Written by: Guo Yuan

Translated by: He Yuanhan

Edited by: Jiang Lu