You are here: Home»

External Relations»

Newsletter»

Henk Vording, The OECD Pillars 1&2 for Taxation of Multinational Enterprises.

Henk Vording, The OECD Pillars 1&2 for Taxation of Multinational Enterprises.

Date:2024-07-05

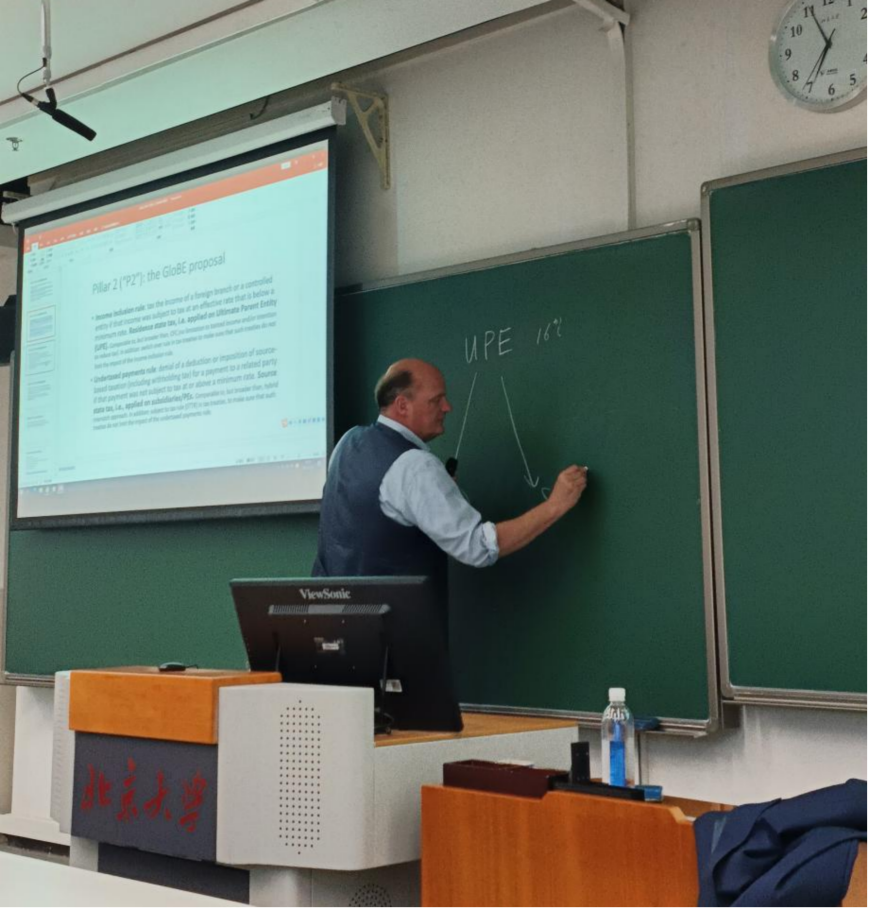

Professor Henk Vording, member of Global Faculty of PKU Law School and Professor at Leiden University Law School, gave lectures entitled “The OECD Pillars 1&2 for Taxation of Multinational Enterprises”. The implementation of Pillar 1 requires a multilateral tax convention, while Pillar 2 relies mainly on domestic law reform. The lecture mainly discussed Pillar 2 from a technical and tax policy perspective, especially focusing on the potential gains and losses for developing countries in implementing Pillar 2 compared to OECD member states.

【Speaker Profile】

Henk Vording has been a Professor of Tax Law at Leiden University Law School since 2006 and he is a former Vice-Dean of Leiden University Law School. He is also a member of Academic Committee of the European Association of Tax Law Professors, a member of Board of the Dutch Association for the Study of Taxation as well as former member of Dutch tax reform committee. He received his MA in History and PhD in Law from Leiden University. He worked as an assistant professor in Economics at Leiden University Law School in 1986 and became an Associate Professor in Tax Law and Economics at Leiden University Law School in 2004. The courses he taught include Introduction to Tax Law, Philosophical Theories of Taxation, and European Tax Policy. His areas of research expertise include European and international tax law and policy (with a focus on corporation income tax), the historical development of tax law and systems, and philosophical foundations of taxation and redistribution. His recent publications include “How The Netherlands Became a Tax Haven for Multinationals” (2019) and “Fiscale Beleidsnotities 2020” (2019).

To learn more about the event, please check out: